The Gamestop Battlefield

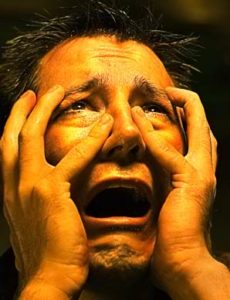

What happened with Gamestop and several other companies whose stocks went from rags to riches in a matter of days? Is this the battle where individual investors fight the good fight against evil hedge funds? Unfortunately, that may not be the case. As with any brutal war, the longer it goes, the more the […]

Current Market Conditions

As we close out 2018, I realize that the significant US stock market declines during the month of December have concerned most people. It is a reminder that investing money is a very serious business and that there are no cookie-cutter investment solutions that work for everyone. Each person has their own investment time […]

A Note on Recent Market Volatility

I am sure that a lot of you have been inundated by news headlines and media reports related to recent volatility in the stock market. Rather than selecting from a variety of third-party discussion pieces on this matter, I wanted to give you my opinion while reiterating the investment philosophy of my company. A VOICE […]

Your Portfolio’s Honeymoon Phase

Most of us are familiar with the honeymoon phase of a relationship; those first 6 months (or so) when you are positive that you’ve met your handsome prince or your beautiful princess. Then reality kicks in. It is only during periods of adversity that you know for sure whether your Dr. Jekyll is […]

Questions We Help Our Clients Answer

There are many ways a financial planner adds value to their relationship with clients. At Gary Alpert & Associates, we are always available for you. Some of the questions we help our clients answer include: 1. Should l refinance my mortgage again? 2. Should l lease or buy a car? 3. Do l need […]

The Gambler’s Conundrum

You are sitting at the table with a pile of chips in front of you. Airfare is already covered as is your room and a few meals. The excitement of Vegas, Macau or whatever the venue is reverberating through your body and your momentum is unmistakable. You have finally figured out how to crack their […]

Dude, Where’s My Cash Reserve?

Dude, where’s my cash reserve is never a question you should be asking yourself. Having 6 months of expenses in an FDIC insured account is the only way to go. You shouldn’t have any less, but circumstances may cause you to need more. Cherish that cash reserve. Be proud of it and bask in […]

Why I Hate Most Target Date Funds and Other Short Stories

Target date mutual funds provide a one-stop shop for retirement portfolios. The target date is the approximate date when investors plan to start withdrawing their money and you get an asset allocation that is geared to a specific retirement year. It then gradually gets more conservative as you inch towards that target date, a seemingly […]

Dear Retirees – Hang Loose Don’t Hang Ten

Financial planner Gary Alpert has made Woodstock home for him, his wife Wendy Helen and their pups, Chloe and Skeeter. “I am a member of the Woodstock Rotary Club and really enjoy giving back to the community,” Gary said. “Wendy Helen and I enjoy supporting various local charities and participating in the business community. We […]

Dare To Be Different

While I am a fairly conservative financial advisor, I like to step out sometimes. My interests include dancing, traveling to third world countries and consuming ethnic foods (particularly Indian and Ethiopian cuisine). I’ve even been convinced to eat a chocolate covered cricket (found in the US and I’m not embarrassed to say it was […]